Why the Angel Round is the Most Ideal Stage for investing in AI Applications?

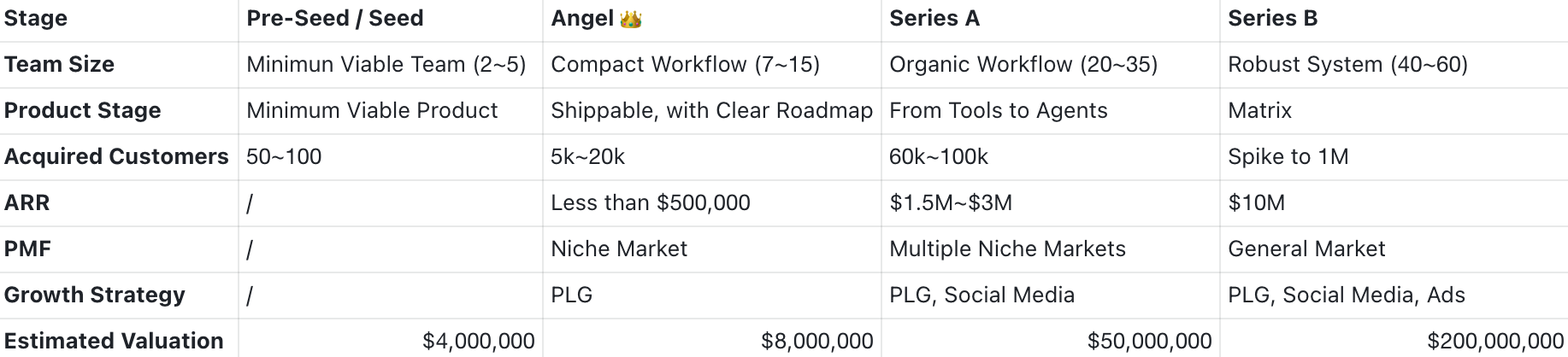

In the fundraising journey of AI application companies, each stage comes with its own set of risks and opportunities. Compared with the Pre-Seed/Seed round—when teams are still refining their prototypes—and the Series A round—when they’re already expanding into multiple niche markets—the Angel round uniquely combines low-cost exploring with rapid growth. This article examines five key dimensions—product maturity, business model validation, team efficiency, valuation cost-effectiveness, and strategy flexibility—to explain why Angel round represents the best stage for AI application companies to achieve a significant value leap.

vs. Pre-Seed / Seed Round

- Product Maturity

- During the Angel stage, the product that startup has been developing takes a leap from its initial Minimum Viable Product (MVP) stage to a fully shippable state, offering not only stable core functionality but also a clear, actionable roadmap. Unlike the Pre-Seed/Seed round—where only prototypes or version 0.1 existed—this stage sees faster iteration cycles, broader feature coverage, and richer use cases, delivering end-to-end solutions that significantly enhance early adopters’ experience and satisfaction. At the same time, by continually refining the user feedback loop, the team can roll out multiple versions in rapid succession, steadily improving the usability and accessibility of key features.

- During the Angel stage, the user base experiences explosive growth within its niche market, leaping from just 50–100 seed users to 5,000–20,000 active users. This scale effect not only supplies large-sample data for product validation but also lays a solid foundation for quickly replicating the business model. As the customer base expands rapidly, the company can more precisely pinpoint niche market demands, further refine product features, and on that basis engage deeply with potential enterprise clients—thus creating a virtuous cycle of scaled promotion.

- Overall, the significant improvement in product maturity and the exponential growth in customer base make the Angel round a key “sweet spot” bridging early exploration and scalable expansion.

- Business Model Validation

- During the Angel stage, business model validation reaches a substantive breakthrough: the company records Annual Recurring Revenue (ARR) for the first time—surging past the $500,000 mark from zero income during the Pre-Seed/Seed round—signaling the product’s transition from technical validation to commercial value realization. By deploying diversified revenue streams such as SaaS subscription fees and usage-based charges, the business has built an initial, self-sustaining cash-flow loop, and ARR is climbing steadily.

- At the same time, the team has successfully achieved Product–Market Fit (PMF) in its initial niche market and validated both pricing strategies and customer Lifetime Value (LTV) in realistic scenarios using authentic user feedback. The larger sample size and more representative insights at this stage dramatically reduce the uncertainty around large-scale rollouts. Moreover, this stage is crucial for testing the product’s growth flywheel: optimizing the user journey with a truly frictionless onboarding experience, continuously boosting activation rates through A/B testing, and embedding referral loops—such as in-app invitations and share-to-use features—that leverage the seed user community to accelerate organic growth.

- The dual validation of ARR and PMF not only boosts the team’s confidence in growth but also lays a solid foundation for future Series A fundraising.

- Team Efficiency

- During the Angel stage, the team grows from just 2–5 people to a compact workflow of 7–15 people, striking the right balance between scale and agility. At this size, members can maintain tight collaboration while also specializing in distinct roles. Beyond the early R&D team, the company brings on dedicated product managers and operations managers, significantly deepening expertise and laying the groundwork for community engagement and viral social-marketing initiatives.

- Compared with the efficiency bottlenecks and decision-making delays caused by individuals wearing multiple hats in the earlier stage, the team at this stage retains startup agility while benefiting from the professionalism that comes with a larger headcount—and at the same time reduces cross-functional friction and duplicate work. Since a startup’s product and market directions often pivot, having a relatively complete organization structure helps the company navigate periods of rapid transformation. Moreover, the compact team size strengthens cultural alignment and lowers turnover, keeping everyone highly focused on the company’s objectives and continuously driving innovation.

- Overall, a compact workflow of 7–15 people strikes the right balance between cost control and strong execution, serving as the key enabler for rapid product delivery and market expansion during the Angel stage.

vs. Series A Round

- Valuation Cost-effectiveness

- In terms of valuation cost-effectiveness, an Angel-stage company is valued at around $8 million—just a fraction of the tens of millions typical in Series A—meaning investors only need to commit a small portion of the capital. This relatively low valuation reduces investors' risk. By investing at this stage, once the company successfully reaches Series A and beyond, its valuation can typically achieve a 5× (or greater) premium, thereby greatly amplifying investment returns.

- Meanwhile, the Angel stage also sees the fastest user growth: active users jump from an initial 50–100 seed customers to 5000-20000 in a very short period—an over‐100× increase. This explosive growth not only underscores the power of a Product‐Led Growth (PLG) strategy but also validates the success of achieving Product–Market Fit (PMF) within a niche market. Such a large user base lays a solid foundation for subsequent data‐driven optimization, word‐of‐mouth diffusion, and diversified monetization experiments, further driving up valuation.

- Based on a typical projection, assuming a final Series B valuation of $200 million, Angel-round investors would see a 25× valuation uplift, whereas Series A investors would only achieve 4×. This “low entry valuation + high growth slope” combination makes it the steepest segment on the risk–return curve.

- Strategy Flexibility

- During the Angel stage, although the product has reached a shippable state, it hasn’t yet fully entered multiple niche markets or launched multi-channel marketing, so the team retains the flexibility to iterate and fine-tune the product/market direction quickly. By leveraging continuously gathered, authentic feedback from its core user base, the team can nimbly adjust technical approaches or business scenarios, promptly validate or invalidate product hypotheses, and avoid the resource waste that comes from premature commitments. In contrast, during the Series A stage companies typically run multiple growth initiatives in parallel across different niche markets; once they ramp up complex channels like social media and paid advertising, any strategic pivot incurs higher operating costs and greater cross-departmental coordination challenges, making it hard to respond efficiently to new demands, and harder for investors to intake.

- During the Angel stage, startups lean heavily on a Product-Led Growth (PLG) model, with Customer Acquisition Costs (CAC) nearly zero. Without the need to fund paid ads, built-in product features enable users to refer and share organically, quickly validating growth tactics and refining the user journey. At this point, startups can rapidly test and tweak their growth flywheel, laying the groundwork for replication across additional niche markets. This “asset-light + low-cost + highly-flexible” exploring environment not only maximizes capital efficiency but also builds a robust data and operational foundation for future scalable expansion.

Inevitably, the Angel stage also carries risks. First, although the product is shippable and has achieved PMF in a single niche market, it hasn’t yet begun expanding into multiple niche markets or the broader general market. In the worst-case scenario, investors may find the company stuck in that one niche and unable to sustain growth. Second, moving into multiple niche markets and ultimately the general market brings a greater pool of competitors—from other AI applications to foundational models, and from startups to tech giants—forcing the company to carve out its own ecological niche in a fiercely competitive landscape. Finally, as headcount increases, the complexity of team management and cross-department collaboration rises in parallel, posing a significant challenge to the founders’ experience of running a company.

All in all, the Angel stage might be the “golden ratio” between exploration and breakout: the product is already shippable with a clear roadmap, the business model has been preliminarily validated with ARR in place, the team’s size and efficiency are optimized, valuation remains relatively low while user growth is explosive, and strategy flexibility is preserved. By making precise moves at this stage, one may not only maximize capital efficiency but also lay a solid foundation for later large-scale expansion—creating a win-win for both founders and investors.